- Compliance

- Regulation

Latest News

- Technology

Latest News

- Data

- ESG

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

EU MiFID II Art 16

The requirements cover:

- Personal transactions by staff;

- Prevention of conflicts of interest;

- Approval of new financial instruments;

- Continuity and regularity of services and activities;

- Management of third parties providing critical services;

- Internal control and risk management mechanism and procedures;

- Recordkeeping; and

- Safeguarding of client ownership rights.

Recordkeeping requirements

Records that are required to be kept include:

- telephone conversations; and

- electronic communications.

Records must be kept even where the communications do not result in the conclusion of a transaction or the actual execution of client orders.

Electronic communications covers a broad range of communication methods that include:

- Emails;

- Social media;

- Tweets;

- Text messaging;

- Chats; and

- Videos.

The retention period for the records is five or seven years if requested by a competent authority.

-

GRIP Extra: DHS investigates ex-CISA director Krebs, Atkins in as SEC chair

Other news includes a whistleblower testifying that Facebook was working with CCP on censorship, Treasury announcing the rollback of 15 rules and guidance statements, and the publication of several ESMA documents.

GRIP2 min read

-

Preparing for the UK’s new commodity derivatives regime

Next steps for firms, including preparing to take advantage of the new exemptions and submitting required applications to relevant trading venues.

CMS18 min read

-

XLOD London 2024: Addressing the proliferation of trade venues

Panelists from Bank of America, NatWest and Natixis discussed the challenges of multiple trade venues.

Alex Viall5 min read

-

What the new payment options for investment research mean

FCA says new rules will make it easier to buy insight and analysis across borders. We spoke to Seung Earm from Ibex Compliance for the industry view.

Jean Hurley2 min read

-

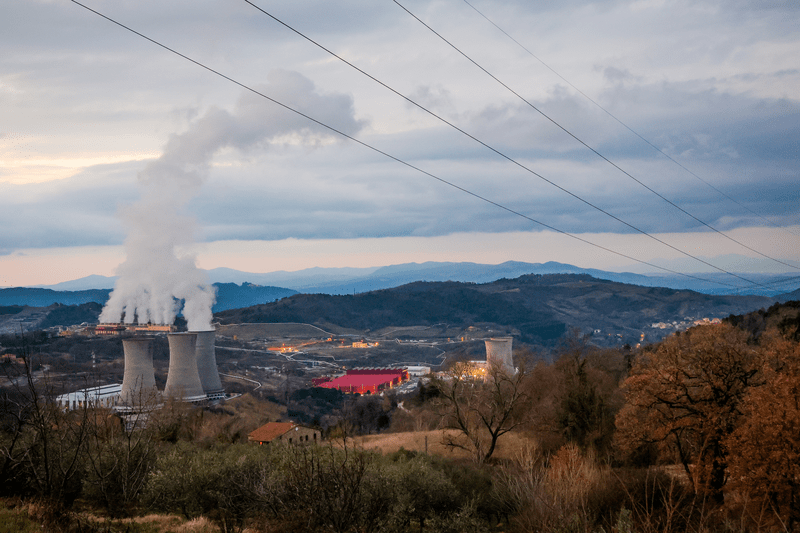

Energy’s rising importance is matched by regulatory scrutiny

Government concern about the state of the energy markets has led to new rules, and to action by regulators targeted at the energy and commodity sector.

Alex Viall5 min read

-

Majority of firms unprepared for costs and challenges of MiCA

Survey finds only 9% of firms are ready to handle the EU's Markets in Crypto-Assets Regulation.

Carmen Cracknell1 min read

-

ESMA consults on pre-trade and post-trade data transparency

The proposal includes a new RTS that converts current guidelines on the cost of market data into legal obligations.

Thomas Hyrkiel1 min read

-

10 key things market participants should know about the EU REMIT Review

Assessing amendments to the regulation on wholesale market integrity and transparency.

Anna Carrier | Norton Rose Fulbright LLP12 min read

Further Reading